【新唐人2011年10月28日訊】稀土是現代許多科技產品的關鍵原材料,中國稀土總產量佔世界稀土產量的95%。近幾個月,國際市場上稀土價格下跌了約20%。中國稀土產量占統治地位的兩大公司決定暫停生產,意圖提高十七種稀土的市場價格,這引起很多國家感到不滿。

中共前領導人鄧小平1992年時曾經說「中東有石油,中國有稀土」。自從那時以來,中國大力開發稀土資源。

不過世界稀土行業頹勢已經引發中國大陸南北稀土停產潮。

繼10月19號,中國最大的稀土生產商包鋼稀土宣佈暫停一個月後,10月25號,南方稀土龍頭五礦贛州稀土礦業公司也宣佈自20號開始全面停產。這次停產預計維持3到5個月。

對此,英國《金融時報》表示,中共政府整治稀土行業,引起了全球稀土市場的動盪。

《美國之音》中文網26號報導,世界上很多國家因為受制於中國,正在採取措施。日本豐田和美國通用等汽車公司已經研究如何盡可能少使用稀土元素。而美國、俄羅斯和澳大利亞都在計畫開發新礦。

英國地質調查局負責人布拉德沃斯說,「長期以來,中國採用低成本分離稀土礦石,使得中國稀土價格不斷下降,造成其他國家的稀土企業紛紛倒閉,隨著許多高科技產品對稀土的需求越來越大。」他認為,只要新開發兩個新的稀土礦,就能改變依賴於中國的局面。

《華爾街日報》也報導說,五角大樓新近提交給國會的一份報告表示,美國應開闢中國以外的稀土供應源。報告顯示,五角大樓已開始著手找出哪些美國公司有可能會將稀土氧化物加工成稀土金屬,並研究了如果稀土供應中斷會造成哪些風險。

印度新德里政策研究中心教授布拉馬•切拉尼也在《金融時報》撰稿指出,中國將稀土資源的壟斷當成一種貿易手段,並阻止解決南中國海爭端的多邊努力,這已引起了國際社會的警覺。而中國謀求把水資源作為一種政治武器的做法,令鄰國深感憂慮。

中國在2008年已經採取限制稀土產量、以操縱價格的措施。此外,在中國2010年跟日本陷入領土糾紛時,還曾經停止對日本出口稀土,把稀土作為一種政治外交手段。

耐人尋味的是,日本大約 83%稀土來自中國,但日本並不急於使用,而是將這些足夠使用20 年的資源貯存在海底,作為未來能源戰略的規劃。

不過,1997—2010年間,中國稀土資源儲量佔全球總儲量的比重已從43%降到30%。按照目前的開採速度,只能維持15—20年。

而,中國對稀土的控制在國內也遇到巨大的阻力。

據《中國青年報》報導,由於稀土開採涉及到利益,「禁採」會直接面對地方政府的阻力。很多地區的地方經濟已經形成了對稀土生產、特別是對稀土出口的依賴。國家對稀土產量和出口量的控制,將直接影響地方經濟利益,同時還有來自稀土企業的阻力。

據調查,在過去10多年裡,中國稀土企業只是出口初級產品,不但利潤非常低,開採稀土所付出的環境成本極為高昂。據介紹,普遍採用的草酸這種池浸工藝,每開採1噸稀土就要破壞200平方米的地表植被,剝離300平方米的地表土層,產生2000立方米尾礦。目前開採稀土一噸賺幾十萬,未來花在環境污染治理上的可能要幾千萬。

新唐人記者宋風、薛莉綜合報導。

****************

The Suspension of Rare Earth Production From China Causes International Concerns

Rare earth minerals are crucial in manufacturing many

modern technological products.

Currently, China produces 95% of the world’s

rare earth minerals.

In recent months, the price of rare earths

dropped by around 20%.

To raise the market price, the largest two rare earth

producers in China have announced the suspension of production, which caused dissatisfaction in many countries.

The former leader of the CCP government, Deng Xiaoping,

said in 1992, “China could produce rare earth minerals, just as the Middle East produces oil.”

Following his words, China has since quickly developed its

rare earth production.

However, the recent rare earth industry recession has

caused many Chinese producers to halt business.

On Oct 19th, the largest rare earth producer in China,

Inner Mongolia Baotou Steel Rare-Earth (Group),

announced it would suspend production for one month.

Following Oct 25th, another rare earth giant in southern China,

Minerals Ganzhou Rare Earth, also announced suspension of

production for 3 to 5 months.

The UK-based newspaper, Financial Times,

wrote an article stating that

the CCP government’s regulation of rare earth production,

has caused turbulence in the global rare earth market.

The VOA Chinese website reported on Oct 26th that many

countries are trying to countermeasure China’s control over rare earth materials.

For example, Toyota and General Motors are carrying out

research on reduction of rare earth elements usage as much

as possible, and The United States, Russia and Australia are

planning to develop alternative rare earth mines.

Andrew Bloodworth, Head of Science Minerals & Waste at

British Geological Survey stated, “For a long time, Chinese

companies have separated rare earth elements

from minerals at a relatively low cost.

This continuously reduces the price for Chinese rare earth

producers, resulting in the widespread closure of foreign producers.

On the other hand, the market demand is also increasing,

since rare earths are necessary in making more and more high-tech products.”

Bloodworth believes that if as few as two new mines

outside China could be developed,

the current dependence on Chinese

rare earth producers would be greatly relaxed.

The Wall Street Journal also reported that the Pentagon

recently submitted a report to Congress suggesting that

the United States should develop rare earth sources

outside China.

The report reveals that the Pentagon has already begun to

research companies which could possibly separate rare earth elements from their oxides.

Studies are underway regarding the possible risk of suspension

from rare earths sources.

Brahma Chellaney, Professor of New Delhi-based Centre for

Policy Research, wrote in Financial Times that China regards

its monopoly on rare earth materials as a trade weapon,

which has played an important role in inhibiting any solution to South China Sea disputes despite multilateral efforts.

Similarly, the CCP government also tries to use water

resources as a political weapon.

Such behavior patterns have worried its neighbors and drawn

the awareness of the international society.

In 2008, the CCP government once restricted its production

of rare earths to control prices in the global market.

It also halted rare earth export to Japan when territorial

conflicts between two countries broke out in 2010.

Clearly, the CCP aims to take advantage of its monopoly on

rare earths in politics and foreign affairs.

An intriguing fact is that though 83% of Japan’s rare earths

are imported from China, the government of Japan has

deposited these resources in the seabed for future use,

rather than deplete supplies immediately.

As part of future natural resources strategy planning, these

deposits could support 20-year usage in Japan.

However, the reserve ratio of rare earths in China has

decreased from 43% to 30% between 1997 and 2010.

At the current rate, the resources would be depleted in

15 to 20 years.

At the same time, the CCP government also encounters

domestic resistance when it tries to control the production of rare earth materials.

The China Youth Daily reported that since huge benefits are

involved in the rare earth industry,

the central government will face resistance of

rare earth production from local governments..

Local economics usually greatly depend on

production of rare earths, especially the export of these materials.

Therefore national control of rare earth export would cause

direct hazard to local economics and rare earth companies themselves.

According to an investigation, in the past 10 years,

the Chinese rare earth industry is only exporting primary products

with poor profits due to very high environmental costs.

For example, under the widely used techniques in China

which use oxalic acid to erode the earth, 200-square-meter vegetation would be destroyed,

a 300-square-meter soil layer would be stripped,

and 2000-cubic-meter tailing materials would be generated to produce only one ton of rare earth materials.

For each dollar of economic benefits, hundreds of dollars

may be spent to deal with environmental problems in the future.

NTD reporters Song Feng and Xue Li

看下一集

【禁聞】浙抗稅民眾指武警打死人 當局否認

【禁聞】陸軍警訓練 對付訪民 機密視頻洩漏

【禁聞】中國的法律體系 能保障人民自由﹖

【禁聞】美國民眾拋棄高福利共產主義

【禁聞】大陸降價退房潮湧 業主維權砸樓盤

【禁聞】中國一胎政策少生4億人?遭抨擊

【禁聞】浙江抗稅變地區衝突 傳政府支持

【禁聞】大陸金融界易帥 危機難解

【禁聞】網管升級 網友諷新四大文明古國

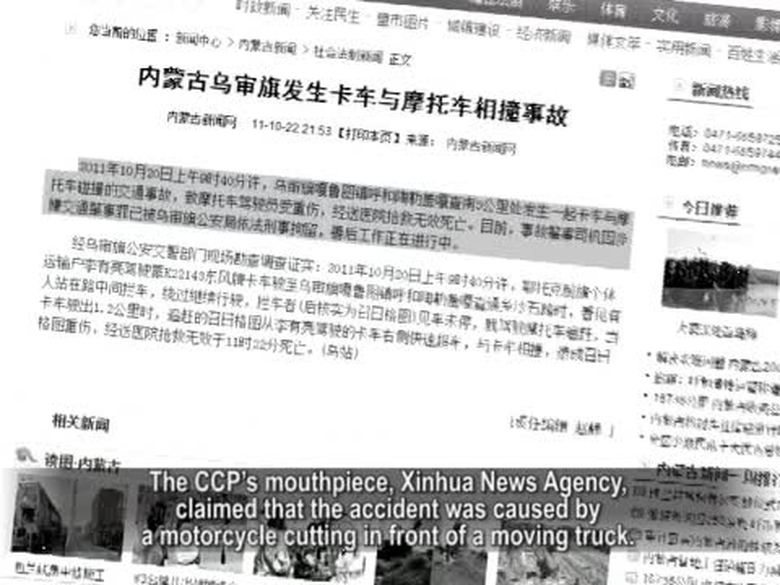

【禁聞】內蒙劍拔弩張 網友:官商勾結所致

【禁聞】江澤民短片炒作貼金 被指料理後事

【禁聞】政治迫害遇難者 從中共噩夢中醒來

【禁聞】停工又車禍 蘭渝鐵路雪上加霜

【禁聞】藝術家求訪「不敏感名人」胡錦濤

【禁聞】法律空運 五毒氾濫

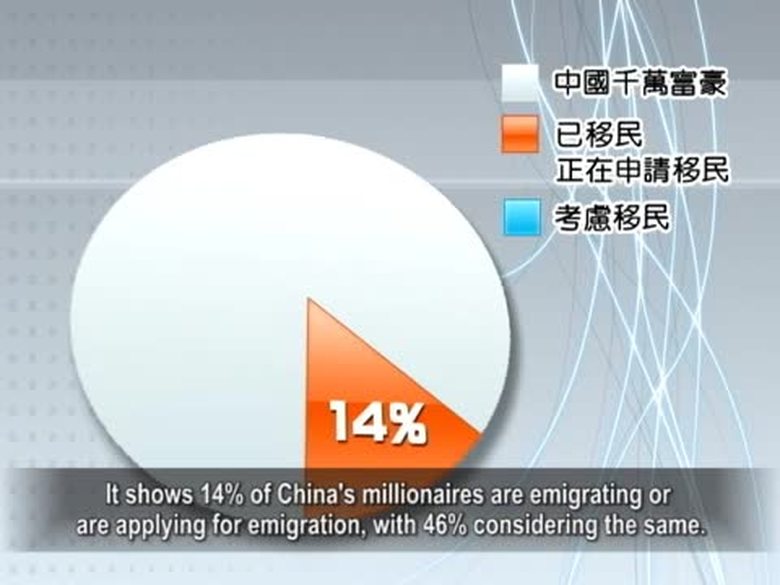

【禁聞】移民潮衝擊中國巨輪