【新唐人2011年11月3日訊】中國知名異見藝術家艾未未,收到北京地稅局送來稅單,要求他公司補交上千萬元人民幣的稅款和罰金。公司法人、艾末未妻子路青表示,處罰依據不清,拒絕簽收,而稅務人員聲稱不得拒收。艾未未指當局是在威脅他,要他屈服和收聲。港媒認為,中共當權者為打壓維權、異議人士,已撕下法治的遮羞布。

11月1號,北京地稅局的幾名工作人員,來到北京草場地258號艾未未「發課工作室」所在地,送來一張稅務通知單,要求「發課公司」在15天內補交1522萬元人民幣的稅款和罰金。

公司法人、艾未未妻子路青表示,公司賬本被當局帶走至今下落不明,處罰依據不清,拒絕簽收。但稅務人員以「留置送達、不簽收也生效」為由,硬將稅單留下。

發課公司律師浦志強:「我們現在正在分析這個稅單和罰單,因為有些科目我們還搞不清楚。他們那個處罰金那上面說的也不清楚。聽證的過程中也沒有看到帳薄的原件,所以,現在不知該怎麼應對。」

艾未未在推特上連續發表推文透露,「發課公司」至今沒有見過帳,會計和經理受到威脅、不許見面,不容溝通。北京稅務局給他15天期限補繳稅款,他不會交款,因為當局至今沒有拿出「發課公司」偷漏稅的證據。

浦志強律師說,疑惑的是,稅務局明確承認沒有「發課公司」的帳薄原件,那麼,稅務局是根據甚麼來定稅的?

浦志強:「作為介入律師來講,沒有任何一個人看到財務帳薄資料,我們也不清楚它(發課公司)這個經營的情況,這個稅務處罰的情況到底是依據甚麼?因為稅務局明確承認賬本不在他們那兒。他們也沒看到原件。」

艾未未提到,公安威脅他說:「國家說你偷稅,你就偷了。國家會改口嗎?你就自認倒楣,你絕望就是了!」

艾未未母親高瑛認為,當局這樣做,不是單純的一個偷稅漏稅的問題。

高瑛:「 整個都是莫名其妙,現在這個罰款呢,它也沒有把人家那個發課公司,原始會計用的那些賬本也不給人家,據說是複印件,給了一點複印件。現在就是路青,她已經找了律師。律師沒法介入啊!人家拿不到原件,你賬本是怎麼回事,人家看不到啊。」

高瑛認為,稅務局也有問題。她強調,當局玩甚麼把戲誰也不知道,如果「發課公司」真的有問題,當局就應該開門見山的,把這些人都召集到一起,在桌面上,把賬本拿出來,一項項說清楚,找出偷稅、漏稅的根據。

對於這件事情,艾未未指出,當局一直把他當成煽動顛覆者。「發課公司」的法人代表是他的妻子,他只負責藝術創作和監製,稅務部門在通知中稱他為「發課公司」的「實際控制人」,是對他打壓的又一舉措。

艾末未對香港《蘋果日報》表示,如果當局僅因為藝術家有不同觀點,表達不同意見,就蠻不講理,惡意報復,這樣只會削弱法治,給社會作出壞榜樣。他希望當局不要靠威脅來維持。

北京學者莫之許表示,中共對政治異己的打擊報復竟然可以毫無顧忌、無所不用其極,連法律遮羞布都不要,活在這樣的國度,讓人如陷深淵、冰冷絕望!

《法國國際廣播電臺》報導,人權組織認為這是北京當局對異見人士刁難打壓的具體體現。

新唐人記者秦雪、唐睿、郭敬採訪報導。

Ai Weiwei Receives a $2.4 Million Tax Bill

Chinese dissident artist, Ai Weiwei, received a tax bill

demanding that he pay over a 1,000 yuan (US$157) plus a penalty.

Ai』s wife, Lu Qing, the company corporate legal advisor,

said that the penalty wasn』t clear and she wasn』t going to sign it.

The tax officers stated that

she should simply accept the tax claim.

Ai pointed out that the authorities are threatening him,

demanding that he give in and sign the bill.

Hong Kong media reported that the

Chinese Communist Party (CCP) ignores the law to suppress dissidents.

On November 1, Beijing local tax authorities paid a visit to Ai

and delivered a tax notification

demanding that Ai pay a RMB15.22 million yuan (US$2.4million)

tax bill within 15 days.

Ai』s wife, Lu Qing, the company』s corporate legal advisor

said that she refused to sign the bill

because the penalties were unclear and the company books

were taken away by the authorities and had not been returned.

The tax officers left the bill with her and threatened to put

a lien on their property, adding that they could process the tax claim without her signature.

"Ai』s company lawyer, Pu Zhiqiang: "We are reviewing the bill

and the penalty, because some of the items are unclear.

The reason for the penalty isn』t clearly stated.

During the hearings, we didn』t see the original company books,

so now I do not know how to deal with it."

Ai』s Twitter posts said his company didn』t see the books,

and the accountant and managers were threatened.

He said that there is no communication with the tax authorities

and they aren』t allowed to make an appointment with them.

Beijing authorities demanded that he pay the bill within 15 days,

Ai is refusing to pay, as there is no paper work to support the charges.

When the tax office admitted that they don』t have a copy

of the original paper work; Lawyer Pu Zhiqiang doubted their words, saying, "Then what is the tax based on?"

Pu Zhiqiang: "None of the lawyers saw the books,

thus we are not clear on the company』s operation circumstances, so what does the penalty refer to?

The tax office said they don』t have the account books

and neither have they seen the original books."

Ai said that the police was threatening him:

"The state says that you are a tax dodger

and that you have been charged with tax dodging.

Will it possible for the state to change its position?

You just have a case of bad luck; there is no hope for you!"

Ai』s mother, Gao Ying, believes that the authority did this to Ai,

It is not simply an issue of tax dodging.

Gao Ying: "It is unreasonable that they presented us with

a tax bill but didn』t return our accounting books.

They only gave us back a few pages.

Although Lu Qing found a lawyer,

the lawyer can』t investigate anything further because no one presented him with the original books."

Gao Ying believes that the tax office has a problem.

She emphasised that no one knows what games the authorities play.

If Ai』s company really has a problem,

the authorities should directly point that out

by calling everyone together and showing the accounting books,

thus clearly pointing out the 『tax dodging evidence.』"

Ai pointed out that the authorities have treated him

as if he was inciting insurgents.

The company』s corporate legal person is his wife.

He is only responsible for artistic creation and production.

The tax office claims that Ai is in charge of the company.

Ai said it is another way to suppress him.

Ai told Hong Kong Apple Daily that because artists

have different views and express different opinions,

the authorities seek malicious revenge on them,

which will only undermine the law.

This provides a bad example to the community.

Ai hopes that the authorities won』t rely on threats

to maintain the so-called stability.

Beijing scholar, Mo Zhixu, stated that the CCP

suppresses dissidents without even bothering to cover up their deeds.

Living in this country is truly depressing.

Radio France Internationale reported that human rights

groups believe that Ai』s tax case is a reflection of Beijing authorities suppressing dissidents.

NTD reporters Qin Xue, Tang Rui and Gui Jing.

看下一集

【禁聞】“雙限令”夜襲珠海 樓市崩盤在即?

【禁聞】「被精神病」濫施 系統迫害法輪功

【禁聞】北京官方淡化空污 民間自設監測

【禁聞】中共十八大差額選舉:裝飾與權鬥

【禁聞】湖南維權村長離奇死亡 再版錢雲會

【禁聞】全球行賄指數 中國倒數

【禁聞論壇】他們帶走了甚麽?

【禁聞】樓市降價大潮來 土地財政陷窘境

【禁聞】網路興“借錢”給艾未未繳罰款

【禁聞】溫家寶自爆:家人在毛時代遭迫害

【禁聞】律師解 中國破案率越高 冤錯案越多

【禁聞】美官方首次公開指控中共網絡間諜

【禁聞】鐵道部獲融資 36債主追債逾2400億

【禁聞】抵制審查 學者致信新浪投資者

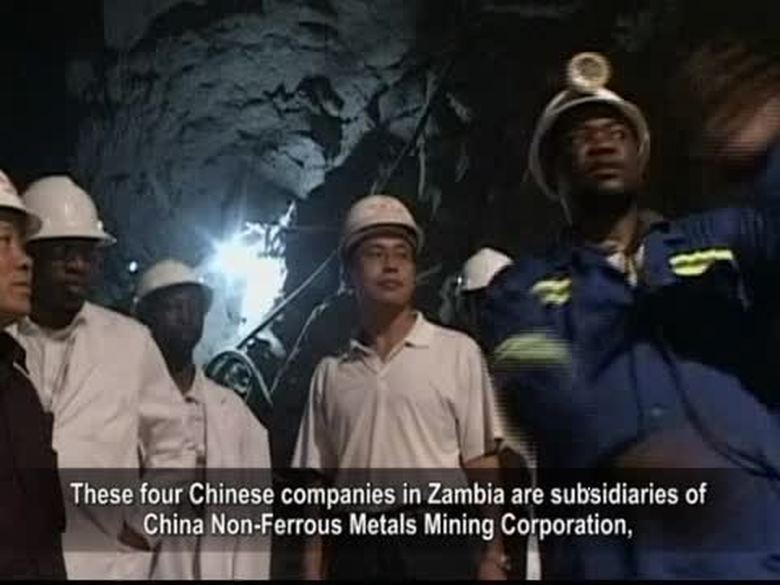

【禁聞】報告:贊比亞中資企業虐勞嚴重

【禁聞】中共感受危機 開始敲警鐘