【新唐人2011年6月11日訊】長期以來,到美國上市,圈美國股民的錢一直是無數中國公司的理想。但事實證明,美國股民的錢,並不像中國股市上那麼好「騙」。 由於中國公司被發現欺詐的概率太高,而成為了美國企業的打假目標。

中國在美國的上市公司過去10年來積纍起來的市場信譽,也許在最近3個月內土崩瓦解。這是外國媒體的最新評價。

英國《金融時報》10號報導,本週三美國股市收盤,中國概念股繼續全線下跌,其中有20檔股票跌幅超4%,3檔股票跌幅超10%,11檔股票跌幅超5%﹔共6檔股票跌破歷史新低或52週新低。

同一天,路透的消息也說,美國券商盈透證券週二發出了強烈的警告說,因為近來眾多中國上市公司涉嫌欺詐,禁止客戶融資買入160家中國公司的股票。其中包括麥考林、新浪、噹噹網、搜狐等知名企業。

一直以來,中國部分企業認為美國資本市場的上市門檻不高,因此想通過到美國上市,希望能圈到美國人的錢。這些企業通過買殼上市的方式進軍美國證交所,這種做法使它們得以避開(IPO)的審查程式。然而,當進入美國市場後,他們才發現自己處於一個多方位的聚光燈下,監管懲罰都非常嚴厲。除了美國證交會、交易所,還有審計事務所、律師事務所、對沖基金、媒體、個人投資者等埋伏在各個角落。

《金融時報》中文網特約撰稿人信海光的文章分析,由於在中國公司當中發現欺詐的概率太高,美國一些對沖基金公司,對借殼上市的中國公司進行調查、做空,甚至等造假公司股票暴跌之後,再補回空頭搶位,以此盈利。

這些打假公司被稱為無孔不入的「空軍」部隊,發動做空機制,有效地制衡市場的造假行為。在近幾個月來,賣空者對數量空前的海外上市中國企業發起攻擊,指控中國企業存在欺詐或其它不當行為。

《21世紀經濟報導》透露,「著名的老虎基金也參與了做空,老虎全球基金僱了兩個人常駐北京,專門打假。」

《金融時報》消息說,僅在過去六個月期間,就有超過25家在紐約上市的中國企業,要不是被披露存在會計問題,要不就是看到企業的審計師辭職。

信海光認為,誠信缺失是中國公司長期以來的一個通病,在中國股市上,造假問題一直沒有得到有效治理。

中國財經評論員邱林則表示,由於中國證監會漏洞百出,所以中國的股市官商勾結、內幕交易比比皆是。他認為,儘管「財務報表虛假」這類事情在中國股市屢見不鮮,但中國企業想在美國以造假圈錢,那可能就是白日做夢了。

新唐人記者李靜、奇緣綜合報導。

Chinese Firms: Investigation Targets

It has been countless Chinese firms』 dream

to have their stocks listed on the U.S. exchanges.

However, the U.S. investors have been proven

to be more cautious than the Chinese stockholders.

As Chinese firms have a large probability of frauds,

they have become targets of fraud investigations.

U.S.-listed Chinese firms』 decade-long reputation

may have been lost in the last 3 months.

This is the latest comments by the foreign media.

UK Financial Times reported on June 10 that

Chinese concept stocks continued to drop broadly.

20 stocks dropped over 4%, 3 dropped over 10%,

and 11 stocks dropped over 5%.

6 stocks fell below their record lows or 52-week lows.

As per Reuters, U.S. brokerage Interactive Brokers

issued a strong warning on Tuesday.

Due to recent frauds of many listed Chinese firms,

it banned its clients from borrowing to buy 160 stocks,

including Mecox Lane, Sina, Dangdang and Sohu.

Some Chinese firms consider the listing thresholds

of U.S. capital markets to be low.

So they want to have their shares listed in the U.S.

These listed firms entered into U.S. stock exchanges

through reverse merger, which allowed them to avoid

the IPO review process. However, after entering U.S,

they found themselves in a multi-faceted spotlight,

with severe regulatory penalties.

Besides SEC, there are stock exchanges, auditors,

law firms, hedge funds, media, and investors.

Financial Times Chinese section』s contributor

Xin Haiguang wrote, as many Chinese firms have

accounting scandals and frauds, after investigation,

some hedge funds would short these firms』 stocks.

After the shares plunge, they cover the short positions.

In doing so, the hedge funds have made profits.

These hedge funds are called "Air Force",

as they initiate a stock shorting mechanism,

which effective controls market frauds.

In recent months, short sellers attacked a large

number of Chinese firms listed overseas,

accusing them of frauds or other misconducts.

Chinese 21st Century Economic Report revealed,

"The famous Tiger Fund also short sold.

Tiger Global Fund hired two people based in Beijing

specializing in detecting frauds.”

As per Financial Times, in the past six months alone,

over 25 New York-listed Chinese firms were exposed

of accounting scandals or auditor resignations.

Xin believes that the lack of honesty has been

a common problem among Chinese firms.

On the Chinese market, frauds were never controlled.

Chinese financial commentator Qiu Lin said,

as China Securities Regulatory Commission』s

regulation is full of loopholes, insider trading and

collusions between officials and firms are common.

False financial statements are common in China.

However, the firms would be day dreaming,

if they think they can commit frauds in the U.S.

NTD reporters Li Jing and Qi Yuan

看下一集

【禁聞】中共有理執政?專家唱衰

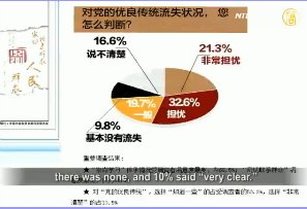

【禁聞】民眾回應官媒調查:中共沒優良傳統

【禁言博客】“唱紅歌”的幾大錯誤

【禁聞】曝豪華政府樓 齊崇淮延長囚禁8年

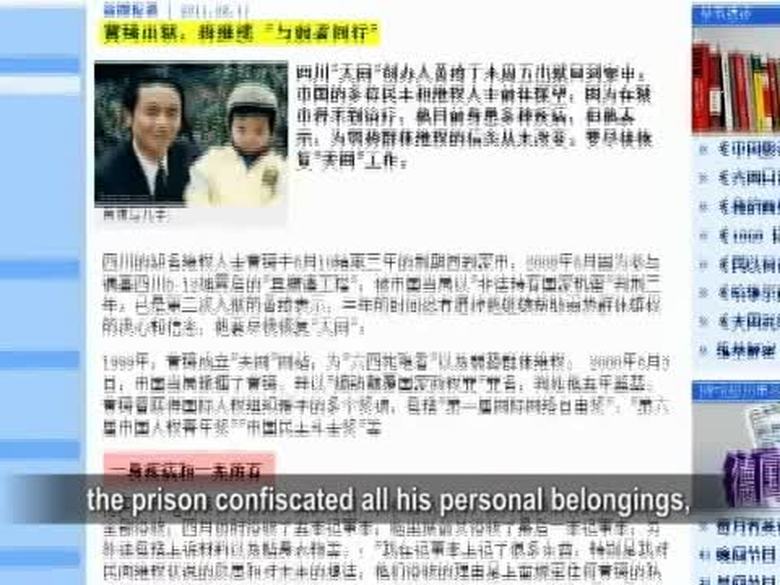

【禁聞】黃琦病情加重 出獄後維權信念未變

【禁聞】李莊自由了!中國律師的前景呢?

【禁聞】中共加裝偷聽器 中港車全竊聽

【禁聞】《建黨偉業》海報 「斧頭幫」再現

【禁言博客】貪官最愛“唱紅歌”

【禁聞】洗不清的水 中國江湖之殤

【禁聞】德國首例中共“610”間諜案獲刑

【禁聞】南海局勢:軍演 改海名航母出巡

【禁聞】廣州增城開槍了!群起抗暴似北非

【禁聞論壇】中國奇蹟演變成中國危機?

【禁聞】誰在開歷史倒車?

【禁聞】中共關55網站 網友:打擊異見聲音